Despite a hot economy and a slight dip in home prices, 2019 was a year of reckoning for Silicon Valley's high-tech giants, with a growing number of residents and city leaders demanding greater contributions to combat the area's deep housing shortage, according to a new report from Joint Venture Silicon Valley.

The Silicon Valley Index, an annual overview of the region's economic and demographical trends, highlights some of the region's most notable trends of 2019, including the continued expansion of commercial development and a slight decline in home sale prices after seven years of rapid gains. While the report celebrates the region's "upward spiral," as evidenced by a $17 billion increase in the regional gross domestic product, a slate of new hotels popping up around the region and 30,000 new jobs, it also details the dark side of the surging economy, including traffic gridlock and housing prices that continue to drive people away.

"Against a flourishing economic backdrop, conditions are harsh for the broad peripheries of the population as inequality reaches new dimensions and wage gains are lost to the rising costs of living," the report's introduction states. "Despite recent progress, the region still has the nation's highest housing prices and our transportation challenges continue to mount."

Russell Hancock, president and CEO of Joint Venture Silicon Valley, reflected on this dichotomy in his introductory letter for the report, which noted that the Bay Area has added 821,000 jobs since the recession of 2008. This, he noted, is the equivalent of dropping another city the size of San Francisco into the region.

While he celebrated the area's engineering savvy, strong universities and deep pools of capital, Hancock also asked: "So why does it feel so tenuous?"

The answer, he says, is insufficient housing stock. The region has only added about 173,000 housing units since 2008, a jobs-housing mismatch of nearly 5 to 1.

"The result is the nation's highest housing prices, an unsettled workforce and a transportation system sagging under the weight of 100,000 megacommuters," Hancock wrote. "Add to this the nation's most sharply pronounced income gaps and you have a formula for despair."

It doesn't help, he added, that the region's driving industries are "facing a backlash the likes of which we've never seen."

"As technology plays a deeper and more pervasive role in nearly every aspect of our lives, that role has come under question and the region feels like it's under siege," Hancock wrote.

Despite the recent years of prosperity, income inequality in Silicon Valley is now at a "historic high," according to the report, with 13% of the households holding more than 75% of the region's wealth. Furthermore, while 13% of the region's households have more than $1 million in net assets, 37% have less than $25,000 in savings.

Even though Silicon Valley and San Francisco remain the two most expensive metro regions in the nation when it comes to housing costs, Silicon Valley's median home sale prices actually declined by 6%, or about $75,000, in 2019. The report posits that this may reflect "a cooling overall market" and possibly a shift of activity away from higher-end homes.

Despite widespread recognition of the region's housing shortage and efforts by state and local legislators to address the housing affordability crisis, building permit activity for residential construction actually slowed in 2019, according to the Index. Most of the permits were issued to homes that are only affordable to high-income individuals.

Apartment rents, meanwhile, remain sky-high compared to the rest of the nation. According to the Index, the median apartment rental rate per square foot in 2019 was $3.76 in San Francisco and $3.32 in San Jose. This is well above the median of $2.67 in California and roughly double the rate of $1.73 in the United States.

The report notes that 23% of Silicon Valley households who rented were "severely burdened" by housing costs, which means they had spent more than 50% of their gross income on housing.

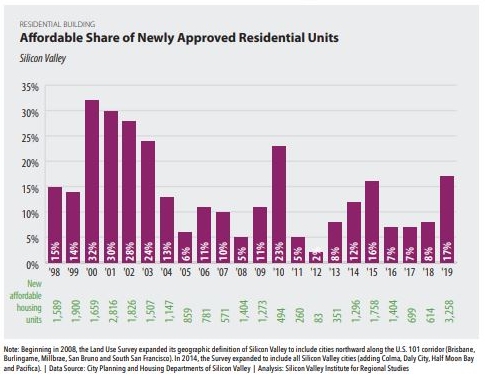

Yet the report also notes that there is a relatively large amount of affordable housing in the region's development pipeline. There were 3,258 "affordable housing" units (those deemed affordable for residents earning up to 80% of the area median income) approved in fiscal year 2018-2019 — more than in any other year of the past two decades. By contrast, there were just 699 units of affordable housing approved in 2017 and 614 in 2018.

And while the affordable housing units made up just 17% of the total number of newly approved units, that is the highest percentage since 2010, when 23% of the new units were deemed affordable (in 2017 and 2018, the share was 7% and 8%, respectively).

The report points out that the shares of multigenerational and multifamily households remain high and that more than a third of all young adults live with a parent.

"Homelessness and housing insecurity remain critical issues," the report states. "Further compounding the issue is the reality that many of Silicon Valley's residential units are vacant, underutilized, inadequate or otherwise deficient."

While residential development is rolling out slowly, commercial growth boomed in 2019, with 8.5 million square feet of commercial space completed in Silicon Valley in 2019 — an 18-year high. And more commercial construction is on the way, with LinkedIn, Google, Microsoft, Adobe and Nvidia all moving forward with constructing office space as 2019 came to an end.

"Although asking rents in Silicon Valley are relatively high compared to other growing tech regions across the nation, the region's major tech companies have continued to expand their presence with an increasing real estate footprint," the Index states.

The link between growing tech campuses and the region's housing and transportation problems has become a major theme for local governments throughout the region. Several cities, including Mountain View and East Palo Alto, have recently instituted business taxes to help address these issues. Palo Alto is preparing to place a business tax on its November ballot, with revenues targeting transportation improvements.

Several candidates for Senate District 13, which includes large portions of San Mateo and Santa Clara counties, also have called for policies that would require tech companies to do more to address the region's housing crisis. Josh Becker has proposed requiring tech firms to build a housing unit for every job they create, while Michael Brownrigg suggested creating a "credit" market for new housing, with residential builders selling credits for new units to commercial developers.

The Index also highlighted the changes in Silicon Valley's population, which is becoming increasingly diverse. Growth has slowed, with more residents migrating out of the region than coming in for the third straight year. According to the Index, Santa Clara County ranked fourth among California's 58 counties for net domestic out-migration between July 2018 and July 2019, trailing only Los Angeles, Butte and Orange counties.

Silicon Valley's share of foreign-born residents has continued to slowly rise, reaching 38% in 2018, according to the Index. This is fueled by employed residents and those working in technical occupations. According to the Index, more of the region's tech talent in 2018 was from India and China than from California and the rest of the United States combined.

The region's housing shortage also has compounded its traffic problems. Despite efforts by municipalities to discourage driving, the Index notes that the average number of miles driven by Silicon Valley commuters has remained steady over the past three years at about 22 miles per day. Solo commuting remains the most common way to get to work, with 73% of employees driving alone, and public transit use per capita has been on the decline since 2015 on almost all systems (Caltrain's ridership declined in 2019 for the first time since 2010).

According to the report, 6.6% of Silicon Valley employees (more than 101,000 people) had spent more than three hours commuting to and from work on a daily basis. "The number of vehicle hours wasted due to traffic congestion: in Silicon Valley and the Bay Area has tripled between 2009 and 2019," the report states.

"Increases in the number of commuters and the utilization of certain commute paths have led to an unprecedented level of traffic delays in Silicon Valley, with 81,000 hours lost to congestion every day — amounting to an estimated loss in regional productivity of as much as $3.4 billion annually," the report states.

View multiple charts illustrating the report's findings here.

Comments