Expenditures continue to outpace revenues for the Menlo Park City School District, but the district will remain financially stable until at least the 2021-22 fiscal year, according to a district staff report.

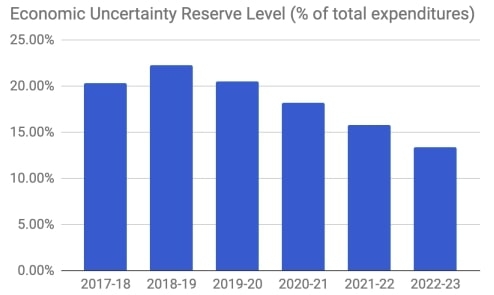

The multiyear budget indicates continued deficit spending will lead to a dip below the school board's policy of holding at least 15% of total annual spending in reserves by fiscal year 2022-23, the report states. For the 2019-20 budget, approved by the school board at its June 11 meeting, the district is able to hold 20.5% of its total annual spending in reserves.

The 2019-20 fiscal year budget projects an operating deficit of $801,907. The district has increased spending on professional development, educational initiatives and targeted staffing to meet its educational goals, according to the staff report.

The school board has had preliminary discussions about pursuing another parcel tax to go on the November 2020 ballot to help with this deficit spending, said Chief Business and Operations Officer Ahmad Sheikholeslami. The district's Measure X, a seven-year parcel tax with an initial rate of $360 per parcel, passed in 2017.

Added to the district's three other parcel taxes, which have no expiration date, total district parcel taxes are about $1,086.82 per parcel for the 2018-19 fiscal year.

Concerns about deficit spending come on the heels of the school board's approval of a teacher compensation philosophy earlier this year, which will require "additional funds that are not part of the current budget planning," according to the staff report. The philosophy is part of the district's efforts to hire and retain the "most qualified and exceptional teachers and staff" given that the district is located in an area of "extreme" high cost of living and has a budget dependent on local revenue sources, according to the district.

Superintendent Erik Burmeister has begun exploring how the district can increase its revenues through endowments, additional community giving and parcel taxes to meet the goals in the philosophy, according to the staff report.

"The district is in a healthy position as it looks at its future compensation philosophy," Sheikholeslami said.

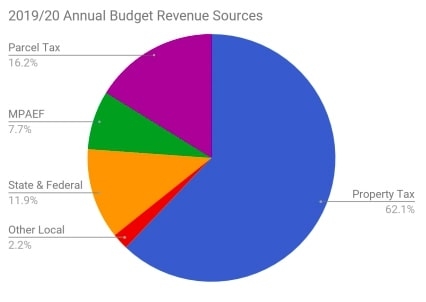

Unlike most California school districts, the Menlo Park district (along with the Las Lomitas, Woodside Elementary and Portola Valley districts) receives very little additional funding when enrollment grows. Because of high local property tax revenues, these school districts are considered community-funded districts and receive almost all their funding from local sources. Districts with lower property tax revenues get money from the state that increases with enrollment.

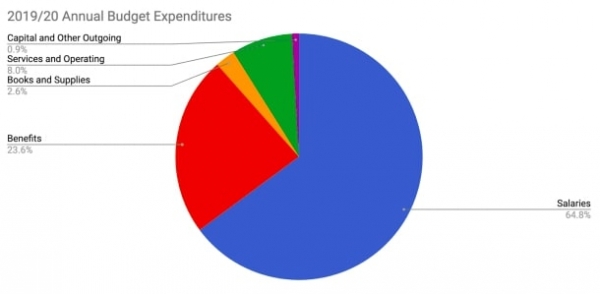

The district has not settled salary negotiations with its two bargaining units and unrepresented employees for the 2019-20 fiscal year, according to the staff report. The budget includes a 2.6% annual increase as a placeholder for pay bumps, movement of employees on the salary schedule, and savings from retirements and resignations.

The 2019-20 annual budget includes total expenditures of $54.4 million, with 88.4% going to salaries and benefits. The district plans to increase its number of employees by the equivalent of 3.86 people.

The district's budget for 2019-20 projects total revenues of $53.6 million, with 86% of revenues coming from property taxes, parcel taxes and donations from the Menlo Park-Atherton Education Foundation.

The full 2019-20 budget can be viewed here. A video of the meeting can be viewed here.

-

Comments

Menlo Park: The Willows

on Jun 21, 2019 at 8:49 am

on Jun 21, 2019 at 8:49 am

Instead of trying for another Parcel Tax try balancing the budget. Enrollment is down slightly over the past few years and is predicted (by the district) to remain flat. Property taxes are up (house prices continue to rise and the amount of taxes increase with every sale). So that means the district has more money to spend on less children and they still can't keep a balanced budget. I for one will oppose a new parcel tax and I am sure the district will spend tens of thousand of dollars, if not hundreds of thousands, to hire consultants to get it passed. Is that really how we want our money spent?

Menlo Park: Downtown

on Jun 21, 2019 at 12:22 pm

on Jun 21, 2019 at 12:22 pm

In the district's budget report, it says quite clearly "A key component of increasing personnel costs is the rising cost of pensions."

The employee pension funds are forcing the district to contribute higher percentages to make up for shortfalls in their investments.

All the high property tax growth is being consumed by the increasing pension costs. That's the reason why reserves will decline in the future despite fast growing property tax revenue.

Menlo Park: Sharon Heights

on Jun 21, 2019 at 1:53 pm

on Jun 21, 2019 at 1:53 pm

I agree with Brian. Why can't the district figure out how to balance the budget? Maybe they need a few astute business people on the Board to show them that this, indeed, can be done and how to do it. In addition, why are they adding personnel at this time when enrolment is projected to be lower? Unfortunately, it will likely be the case that the District will hire consultants, do a number of phone surveys, float a new parcel tax and continue to spend, spend, spend. Luckily, I am now over 65 so I can opt out of parcel tax payments for schools.

another community

on Jun 22, 2019 at 1:52 pm

on Jun 22, 2019 at 1:52 pm

There is NO justification for a 5th parcel tax.

1: We already approved Measure X, under the guise promoted by the district that it would help account for increasing enrollment and pension costs. But enrollment is DOWN since then, not up.

2: Revenue/student has easily outpaced student population growth and inflation:

Since the 2000/02 school year:

* Student population growth has averaged 2.27%/year.

* Revenue/student growth has averaged 3.79%/year.

* The CPI (ie inflation) has averaged 2.67%/year.

As you can see, revenue growth has outpaced population and inflation. MPCSD is exceedingly well funded. Additionally, MPCSD has THE HIGHEST AVERAGE TEACHER SALARY out of ALL bay area elementary school districts. Observe: Web Link

Say NO to 5 parcel taxes!

Menlo Park: Downtown

on Jun 24, 2019 at 11:19 am

on Jun 24, 2019 at 11:19 am

The elephant in the room is unfortunately CALSTRS. This is the state teachers' retirement system, and is in a similar place as CALPERS - about 65% funded, with mandatory contributions showing a significant increase every year.

If you want to get budgets under control, the key is to rip off the pension band-aid and move to defined contribution retirement plans - the sooner the better!

Menlo Park: Downtown

on Jun 24, 2019 at 2:46 pm

on Jun 24, 2019 at 2:46 pm

I can see it now!!!

"JUST a latte a day (for the next 10 years) to pay for teachers guaranteed pensions." ooooppps I meant its for the children,,,,,, and for property values,,,,,,, and if you care about the future,,,,,,, and (((insert winning slogan here)))...

Menlo Park: other

on Jun 25, 2019 at 5:42 pm

on Jun 25, 2019 at 5:42 pm

Let's not forget that the Parent Teacher Organization and the Menlo Atherton Foundation also hit up the parents for about $1500 per child in "voluntary" donations that they put a lot of pressure on people making. It seems to me that the School district board and superintendent to go back to school and take some basic classes on budgeting and financial management. You spend what you have and if you have to make tough calls you do.

another community

on Jun 25, 2019 at 7:52 pm

on Jun 25, 2019 at 7:52 pm

I did a little digging through the financials over the last few years. In a nutshell, using the district's own numbers and estimates, comparing the 2016/17 (pre-Measure-X) school year vs 2019/20 school year:

* Student population DROPS 72 students in 2019/20;

* Contributions to CalSTRS will be roughly $2 million higher in 2019/20;

* Revenue (property+parcel+misc taxes) will be $8.2 million higher in 2019/20;

There is no need for 5 parcel taxes. None.

Vote NO on another parcel tax.

(sources: Web Link Web Link )

Registered user

Menlo Park: other

on Jun 25, 2019 at 8:51 pm

Registered user

on Jun 25, 2019 at 8:51 pm

"Vote NO on another parcel tax."

Agreed. Counting the days until the board comes forward saying we "must" pass another parcel tax "for the kids" or it will be the "end of the world". More of the same BS they used to pass the last parcel tax. Wasn't necessary then and DEFINITELY not necessary now.