As Wells Fargo prepares to unload its huge apartment portfolio in East Palo Alto, city residents, officials and tenant activists are gearing up for another battle to preserve rent control in the city's Woodland Park neighborhood.

Dozens of critics of the proposed sale marched from East Palo Alto to Wells Fargo's branch in downtown Palo Alto Monday afternoon (Aug. 22) in protest of the bank's selection of Equity Residential as a finalist in the sale of about 1,800 units -- about 70 percent of the city's total stock of affordable housing. The apartment portfolio was previously owned by Page Mill Properties, a Palo Alto-based firm that lost control of the units after it defaulted on a $50 million loan to Well Fargo in August 2009.

Equity Residential is a real-estate investment trust that specializes in apartment complexes. Its portfolio includes apartments in Berkeley, Sunnyvale and Santa Clara. Wells Fargo called Equity in a statement "a very experienced owner of apartments" and "an exceptionally well-capitalized firm with an extensive track record of handling large, complicated transactions." The bank also said it would "continue to maintain a dialogue with the community."

But on Monday, many of the protesters voiced frustrations that the bank has ignored their input -- particularly their request that the apartment portfolio be split up and not sold in aggregate to one buyer. They also said they were worried about the fact that the bank has chosen Equity as its finalist. The company is chaired by Sam Zell, a real-estate magnate whose companies have a history of challenging rent-control laws and making profits off distressed assets.

Equity is now reportedly in the due diligence phase of the negotiations. It has already held several meetings with East Palo Alto officials but has not yet proposed a specific development plan. Residents and several council members said Monday that they fear the plan would ultimately include a dramatic reduction of rent-control units and potential displacement of thousands of East Palo Alto residents.

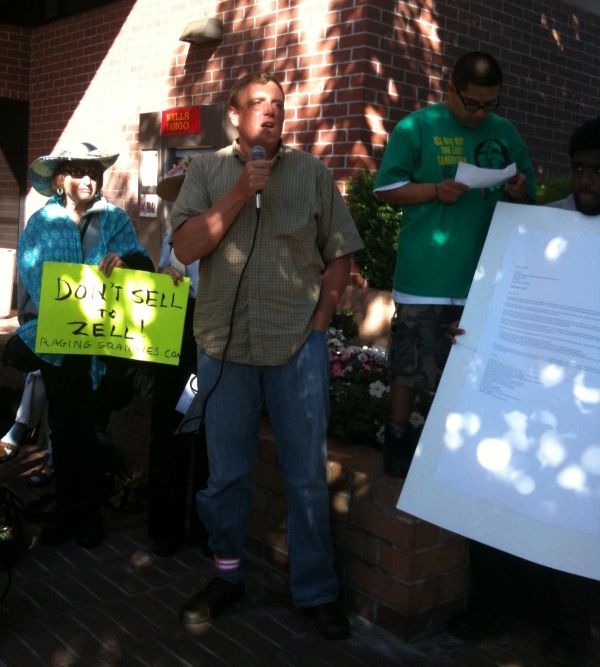

Armed with bullhorns and picket signs, more than 50 residents and tenant activists marched from Newell Court in East Palo Alto to the Wells Fargo branch on Hamilton Avenue in Palo Alto, where dozens more joined them in protest chants ("Don't sell to Zell," "Wells Fargo, you can't hide/ We can see your greedy side," and "If we sell out, they'll kick us out."). The crowd included Mayor Carlos Romero, Councilman Reuben Abrica and members of a tenant-rights coalition that includes the groups Youth United for Community Action, Community Legal Services and the Fair Rent Coalition.

Matthew Fremont, who sits on East Palo Alto's Rent Stabilization Board, said Monday that Equity officials have proposed doubling the density in the neighborhood. This, he said, would inevitably mean reducing the number of rent-control units in Woodland Park. Fremont, who is a tenant at one of the buildings that would be sold, said the new apartments would be far out of the price range of the neighborhood's current residents.

"Do you think they'll build the new buildings for the tenants who live there today?" Fremont asked the protesters as they gathered in front of Wells Fargo branch. "Of course not!"

Mayor Carlos Romero said his biggest issue with the proposed sale isn't so much that Equity is the buyer as the fact that all the properties would remain under one owner. This, he said, gives the developer enormous leverage when dealing with the city.

Romero was one of several city officials who have met with Equity and Wells Fargo representatives in recent weeks to discuss the pending sale. He said Equity officials said they would respect the laws of the city and would continue to discuss their plans with the community. But the company's deep pockets and potential ownership of more than half of the city's affordable-housing stock would give Equity "tremendous power" in these discussions, Romero said.

"I am the first to admit that change is inevitable in any urban environment," Romero said. "The ability of the city to negotiate with the developer about this change is what this community is fighting for.

"The aggregation makes for a very disparate power-sharing agreement between the community and the developer," Romero said.

Abrica, who is also a Wells Fargo tenant, voiced similar concerns and said he is worried about Equity's long-term plans for the neighborhood -- particularly about the possibility of rent-control being abolished.

"I am afraid it could be a repeat of Page Mill Properties behavior -- possibly on a bigger scale and possibly not right away," Abrica said. "In terms of change, a new developer can do away with a low- and moderate-income housing."

Comments